From Dreams to Goals

Place your dreams in a mode like academics.

Let prayer become central in your habit,

let your passion reflect your attendance,

let your success represent your grades--

in such a way that as time passes

in your matriculation,

you are closer to graduation,

rather than the first day of class.

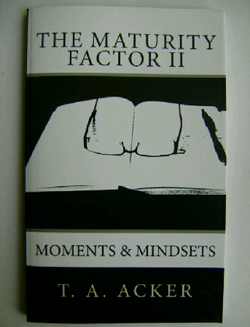

(Poem taken from the book, The Maturity Factor II: Moments and Mindsets by T. A. Acker, ©2012, www.amazon.com, www.poetryandsense.com)

RSS Feed

RSS Feed